DE

DE- Industries

- Finance

Nearshore software development for finance—secure, scalable, and compliant solutions for banking, payments, and APIs.

- Retail

Retail software development services—e-commerce, POS, logistics, and AI-driven personalization from nearshore engineering teams.

- Manufacturing

Nearshore manufacturing software development—ERP systems, IoT platforms, and automation tools to optimize industrial operations.

- Finance

- What we do

- Services

- Technologies

- Collaboration models

Explore collaboration models customized to your specific needs: Complete nearshoring teams, Local heroes from partners with the nearshoring team, or Mixed tech teams with partners.

- Way of work

Through close collaboration with your business, we create customized solutions aligned with your specific requirements, resulting in sustainable outcomes.

- About Us

- Who we are

We are a full-service nearshoring provider for digital software products, uniquely positioned as a high-quality partner with native-speaking local experts, perfectly aligned with your business needs.

- Meet our team

ProductDock’s experienced team proficient in modern technologies and tools, boasts 15 years of successful projects, collaborating with prominent companies.

- Our locations

We are ProductDock, a full-service nearshoring provider for digital software products, headquartered in Berlin, with engineering hubs in Lisbon, Novi Sad, Banja Luka, and Doboj.

- Why nearshoring

Elevate your business efficiently with our premium full-service software development services that blend nearshore and local expertise to support you throughout your digital product journey.

- Who we are

- Our work

- Career

- Life at ProductDock

We’re all about fostering teamwork, creativity, and empowerment within our team of over 120 incredibly talented experts in modern technologies.

- Open positions

Do you enjoy working on exciting projects and feel rewarded when those efforts are successful? If so, we’d like you to join our team.

- Candidate info guide

How we choose our crew members? We think of you as a member of our crew. We are happy to share our process with you!

- Life at ProductDock

- Newsroom

- News

Stay engaged with our most recent updates and releases, ensuring you are always up-to-date with the latest developments in the dynamic world of ProductDock.

- Events

Expand your expertise through networking with like-minded individuals and engaging in knowledge-sharing sessions at our upcoming events.

- News

- Blog

- Get in touch

24. Feb 2025 •7 minutes read

Digitalization in Sweden’s finance sector 2025: Key trends and outlook

ProductDock

Sweden has long been at the forefront of the finance sector, boasting one of the highest numbers of nationally licensed payment institutions in the EU.

With the early adoption of digitalization, the country has rapidly accelerated technological growth, making the Swedish finance market highly competitive. To stay ahead, businesses in banking, investments, fintech, insurance and regulatory compliance must adopt cutting-edge solutions, such as online banking software, portfolio management systems, mobile banking apps, AML systems, payment processing platforms, and other advanced technologies. As growing demand for financial technology advances, concerns over regulations, cyber threats and money laundering are rising, creating new trends for 2025.

Source: Market study: The Swedish market for IT services, Open Trade Gate Sweden, October 2024

The rise of digital banking & fintech

Among these innovations, AI-driven financial services like personalized banking and robo-advisors are becoming essential tools for tailoring financial solutions to individual needs.

Looking ahead, the neobanking market in the Nordics is expected to increase by 13.12%, leading to a market volume of US$192.90 billion by 2028.

At the same time, the concept of embedded finance is gaining traction, as businesses across various industries are integrating financial services into their platforms to offer seamless payment solutions. This shift has contributed to Sweden’s rapid growth in fintech applications, with downloads increasing by 14.9% between February 2023 and February 2024.

As consumer expectations evolve, finance companies need to follow by expanding their offerings, if they already don’t have it, with features like mobile payment gateways, AI-powered chatbots, real-time notifications, advanced security, smart budgeting tools, investment management, user-friendly interfaces, and more to stay competitive in this rapidly evolving landscape.

Continuously enhancing fintech applications is essential for maintaining a competitive edge. VisualVest, a platform-as-a-service provider for Germany’s cooperative banking sector, recognized the need to streamline their financial services, improve customer interactions and provide personalized advice to their users.

By investing in the development of its platform, VisualVest not only improved transparency and accessibility of financial investments but also strengthened its position as a fintech leader, ensuring its platform meets customer expectations in the digital environment.

The evolution of payments and transactions

Sweden is pioneering the shift towards a cashless society, progressively replacing cash payments with digital transactions. With platforms like Swish and tokenized deposits, digitalization in Sweden’s finance system is enabling faster, more secure financial transactions. With mobile banking becoming the preferred payment method, the Swedish Mobile Payments Market is projected to grow at a CAGR of 21.3% between 2025 and 2030.

Considering that almost everyone aged 15 to 65 in Sweden has downloaded Swish, an app that enables users to send and receive money swiftly and efficiently, it’s clear that Swish users are eager to embrace innovative mobile apps that simplify their financial transactions.

BMS Corporate Solutions GmbH, which oversees the corporate customer segment of Germany’s cooperative banks, is a prime example of how investing in financial product development can significantly improve customer satisfaction.

By enhancing the quality of their codebase, and optimizing the speed and reliability of the existing applications, they drastically reduced the number of reported bugs. This enabled them to deliver more successful and seamless digital solutions to end users.

However, integrating mobile payment solutions comes with challenges, including the risks of cyberattacks, identity theft, and online fraud. To mitigate these risks, advanced technologies like AI and blockchain are essential in securing digital transitions.

Known for its ability to improve security, transparency and efficiency, blockchain is becoming a game-changer for the financial industry. This technology enables faster, more secure transactions while reducing reliance on traditional banking systems, making it especially valuable for international payments.

Furthermore, blockchain is creating new opportunities, such as fractional ownership, which allows retail investors to receive a proportionate share of the returns.

Source: Market study: The Swedish market for IT services, Open Trade Gate Sweden, October 2024

Tokenized deposits are also emerging as a fast-growing trend in Sweden, with several payment providers exploring their potential to eliminate the need for pre-funded and multiple correspondent bank accounts. This approach enables constant movement of value and streamlines financial transactions.

AI solutions are also playing a critical role in enhancing financial security. By analyzing vast amounts of data in real time, AI technologies can detect transaction patterns, predict potential fraudulent activities, and strengthen the overall security of mobile apps and digital platforms.

The e-krona project by Riksbank

The Riksbank’s e-krona project is a pioneering initiative exploring the potential of introducing a digital central bank currency in Sweden. The e-krona is a defining milestone in digitalization in Sweden’s finance, reinforcing the country’s role as a global innovator in digital payments. This project aims to create a secure digital payment method that complements cash, catering to the needs of a society that increasingly favors digital transactions.

As cash usage declines, the e-krona could ensure that all citizens have access to a state-guaranteed means of payment, reinforcing the Riksbank’s commitment to maintaining a stable and efficient payment system.

By providing a digital alternative to cash, the e-krona project positions Sweden at the forefront of financial innovation and digitalization.

The role of central clearing houses in cross-border payment integration

Central clearing houses like Bankgirot play a crucial role in the Swedish financial infrastructure, particularly in facilitating cross-border payments.

Bankgirot, alongside Nasdaq Clearing, ensures the smooth processing of transactions by acting as intermediaries that mitigate counterparty risks. These institutions support the integration of Sweden into the Single Euro Payments Area (SEPA), enabling seamless and cost-effective financial transactions across European countries.

The Riksbank’s payment system (RIX) further complements this infrastructure by handling large payments between banks and financial institutions, ensuring stability and efficiency in the financial system. This robust framework allows Sweden to maintain its competitive edge in the global financial market.

Cybersecurity & data protection in finance

As digitalization in Sweden’s finance deepens, cybersecurity and regulatory compliance will only become more important. This rapid expansion into the digital landscape brings security risks. Financial institutions are increasingly targeted by cybercriminals who exploit vulnerabilities in systems to access sensitive data and disrupt services. In fact, according to the IBM X-Force Threat Intelligence Index, Europe recorded the highest number of cyber threats in 2023, making up 32% of global attacks.

To mitigate these risks, in 2025, Swedish fintech companies are investing in advanced threat detection systems based on AI, comprehensive data encryption and multi-factor authentication protocols to safeguard sensitive data and maintain customer trust. Estimates show that the cybersecurity market in Sweden is expected to generate US$1.64bn in revenue in 2025, highlighting the growing importance of digital security in the financial sector.

“Early warning systems will be key in staying ahead of cyber threats, acknowledging that cyber threats will continuously develop. I envision early warning systems collecting information globally to enable the rapid distribution of information and experience. With the growing adoption of cloud services, I see companies keeping cybersecurity solutions up to pace with emerging threats by seeing it as a continuous process, meaning it’s not one, or a few, fixes.”

Anonymous cybersecurity professional

Compliance with various local and international regulations is obligatory when developing a financial platform in the EU. The General Data Protection Regulation (GDPR) sets strict guidelines for how personal data must be collected, processed and stored. As a result, finance companies must integrate secure data storage systems, encrypt sensitive information and establish clear protocols for handling data.

Additionally, companies have to comply with the Cybersecurity Act and Directive on Security of Network and Information Systems (NIS2), tax laws, commitment to transparency and anti-corruption, and sector-specific regulations.

Kerberos Compliance is one of the leading providers of digital solutions for money laundering prevention in Germany, helping businesses meet strict EU and national AML regulations. To improve their services, they developed AML Desk, a comprehensive solution designed to streamline compliance processes and improve efficiency. This solution digitized document management, eliminated email clutter and Excel-based workflows and accelerated work processes.

Additionally, the introduction of a centralized compliance portal simplified regulatory adherence by keeping all necessary documents in one place, reducing time on paperwork and making it easier to pass authority audits.

Challenges and opportunities for finance companies

While digitalization in Sweden’s finance creates new avenues for growth, it also places pressure on companies to invest in talent, tech, and compliance. The rapid digital transformation of Sweden’s finance sector presents both significant challenges and opportunities for businesses. The rise of neobanking and fintech startups has intensified competition, pushing traditional banks to modernize their services to stay relevant in a digital-first economy.

One of the biggest challenges is navigating complex regulatory requirements and ensuring secure data management. Given the sensitivity of financial information and the increasing threat of cyberattacks, companies must invest in advanced security measures.

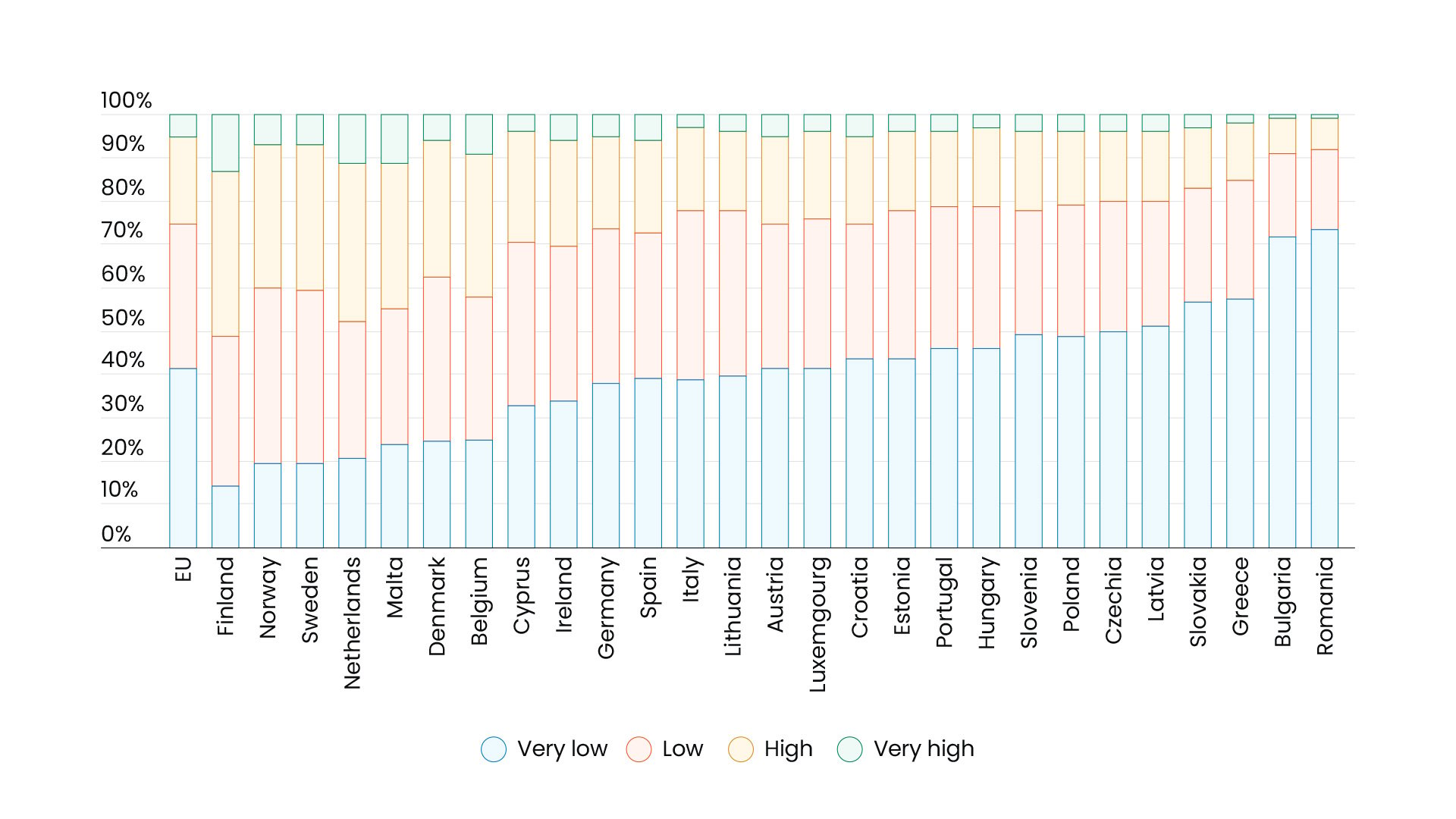

Another key hurdle that slows digital transformation is a shortage of software development talent in Sweden. With approximately 80% of Swedish tech companies lacking reliable IT partners, financial institutions are increasingly turning to outsourcing. The outsourcing market in Sweden is projected to grow at an annual rate of 8.6% from 2024 to 2029, reaching a volume of USD 8.896 billion by 2029.

Despite these challenges, Sweden remains a leader in digitalization with strong adoption of AI, cloud integration and IT security solutions. The rising demand for international digital talent presents new opportunities, and financial institutions that invest in scalable digital solutions and strategic partnerships will strengthen their position in the competitive market.

Conclusion & future outlook

The driving force behind these trends is real customer demand. To succeed in the Swedish marketplace, businesses must demonstrate their ability to meet the evolving preferences and needs of their users.

The rise of digital banks, blockchain technologies, AI-driven financial tools and payment processing systems is transforming the way financial services are delivered, significantly shaping the future of the industry.

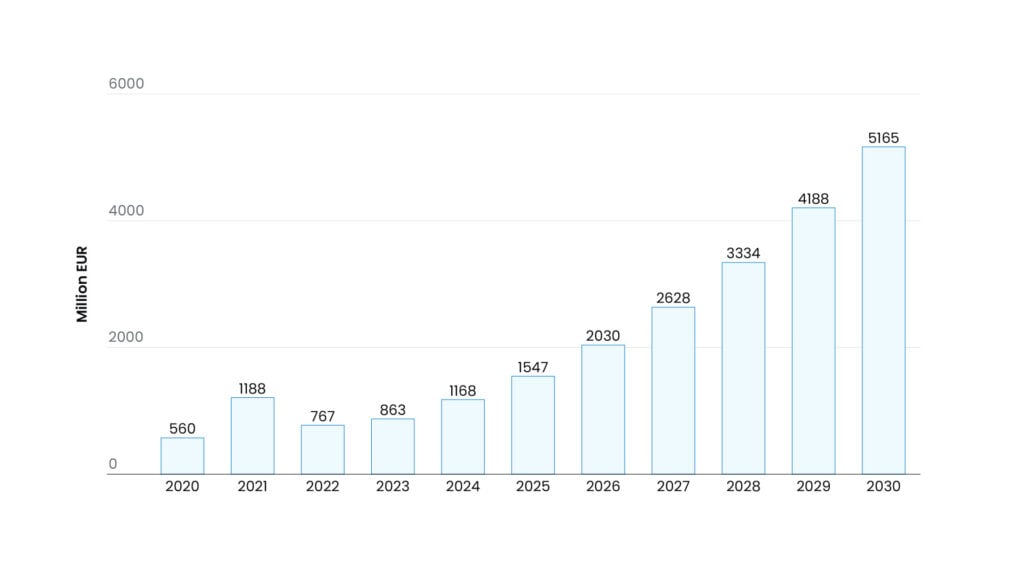

Looking ahead, Sweden’s financial sector is poised for continued digitalization. By 2030, Sweden is expected to surpass local demand for software solutions by 7.4 times, with rapid growth in areas like natural language processing, machine learning and computer vision. Digitalization in Sweden’s finance sector will only accelerate as demand for AI, blockchain, and mobile banking tools outpaces traditional IT resources.

This demand presents a significant opportunity for IT service providers to offer advanced solutions, positioning Sweden as a leader in financial digitalization.