DE

- Industries

- Finance

Nearshore software development for finance—secure, scalable, and compliant solutions for banking, payments, and APIs.

- Retail

Retail software development services—e-commerce, POS, logistics, and AI-driven personalization from nearshore engineering teams.

- Manufacturing

Nearshore manufacturing software development—ERP systems, IoT platforms, and automation tools to optimize industrial operations.

- Finance

- What we do

- Services

- Technologies

- Collaboration models

Explore collaboration models customized to your specific needs: Complete nearshoring teams, Local heroes from partners with the nearshoring team, or Mixed tech teams with partners.

- Way of work

Through close collaboration with your business, we create customized solutions aligned with your specific requirements, resulting in sustainable outcomes.

- About Us

- Who we are

We are a full-service nearshoring provider for digital software products, uniquely positioned as a high-quality partner with native-speaking local experts, perfectly aligned with your business needs.

- Meet our team

ProductDock’s experienced team proficient in modern technologies and tools, boasts 15 years of successful projects, collaborating with prominent companies.

- Our locations

We are ProductDock, a full-service nearshoring provider for digital software products, headquartered in Berlin, with engineering hubs in Lisbon, Novi Sad, Banja Luka, and Doboj.

- Why nearshoring

Elevate your business efficiently with our premium full-service software development services that blend nearshore and local expertise to support you throughout your digital product journey.

- Who we are

- Our work

- Career

- Life at ProductDock

We’re all about fostering teamwork, creativity, and empowerment within our team of over 120 incredibly talented experts in modern technologies.

- Open positions

Do you enjoy working on exciting projects and feel rewarded when those efforts are successful? If so, we’d like you to join our team.

- Candidate info guide

How we choose our crew members? We think of you as a member of our crew. We are happy to share our process with you!

- Life at ProductDock

- Newsroom

- News

Stay engaged with our most recent updates and releases, ensuring you are always up-to-date with the latest developments in the dynamic world of ProductDock.

- Events

Expand your expertise through networking with like-minded individuals and engaging in knowledge-sharing sessions at our upcoming events.

- News

- Blog

- Get in touch

03. Mar 2025 •6 minutes read

Nearshoring software development in finance sector: Benefits and best practices

ProductDock

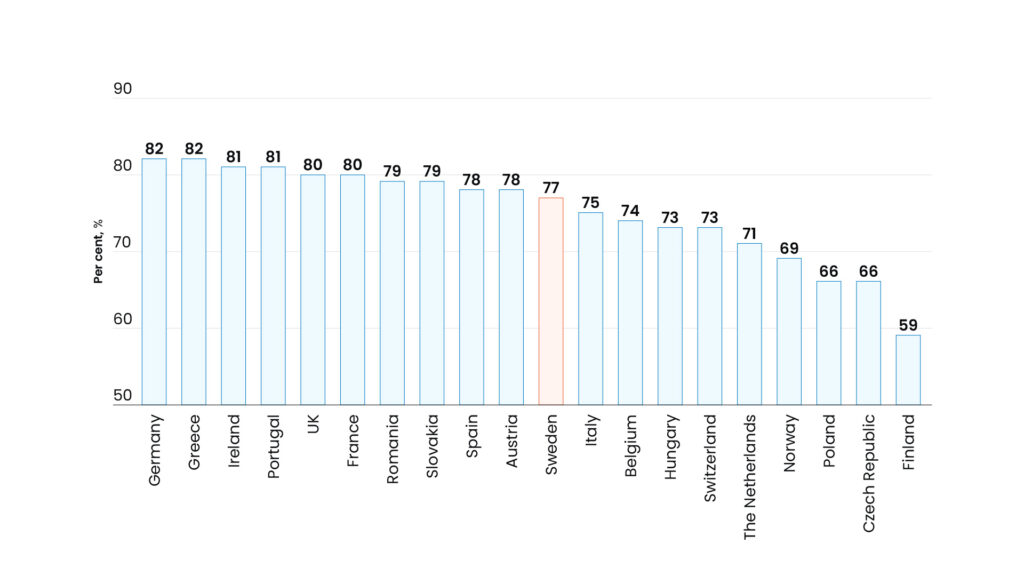

One of the biggest challenges digitalization brings to the finance sector in Sweden is the shortage of skilled software developers. According to the Association of Swedish Engineering Industries, approximately 80% of Swedish tech companies lack reliable IT partners. This talent gap poses a significant obstacle for finance companies seeking to leverage payment processing, cloud computing and regulatory compliance software to improve security, efficiency and customer experience.

As a result, financial companies are adopting nearshoring software development as a strategic solution to access skilled talent while maintaining cost efficiency. In this article, we’ll explore how nearshoring software development works in the finance industry.

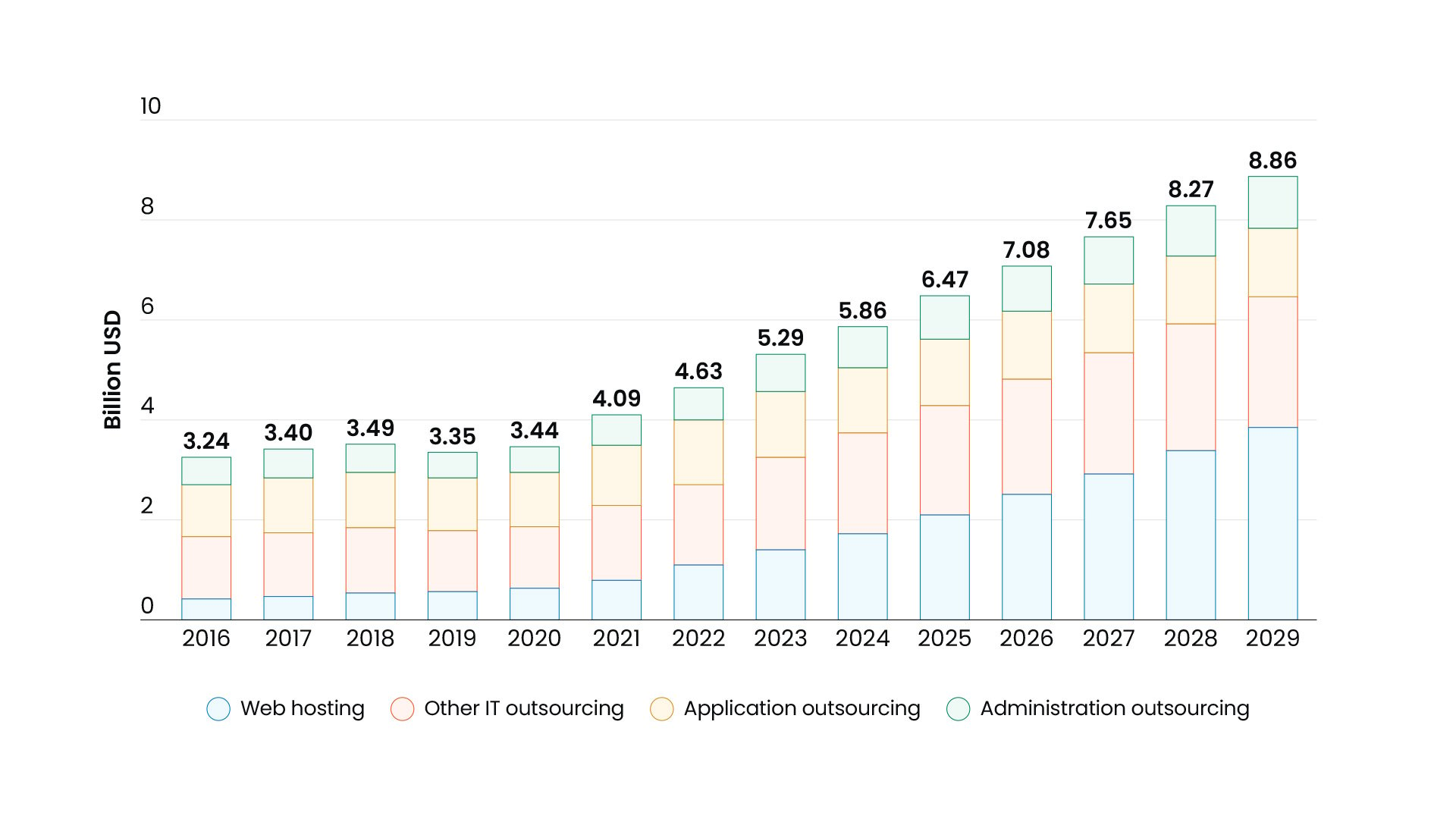

Source: Market study: The Swedish market for IT services, Open Trade Gate Sweden, October 2024

Understanding nearshoring software development in the finance sector

Thanks to the geographical proximity, fewer cultural and time zone differences, and greater regulatory alignment, nearshoring stands out as the most efficient outsourcing model in Sweden. This approach which involves outsourcing business processes and software development to a nearby country is particularly well-suited for the finance sector where security, compliance and seamless coordination are essential.

In the finance sector, nearshoring software development involves outsourcing IT specialists to build and enhance digital products, such as mobile banking apps, online banking software, trading platforms, claims management systems, payment processing solutions, CRM systems, and other innovative financial solutions.

Key benefits of nearshoring in the fintech industry

Rapid access to top-tier technology experts and cost savings

Sweden is experiencing a skill shortage, particularly in engineering, IT and data, leading to rising salaries and increased competition for talent. Since 2022, salaries for software developers with three years of working experience have increased by 12% since 2022, making it difficult for small and mid-sized companies to compete with financially stronger corporations for IT professionals.

In this context, nearshoring has become a game changer for digitalization in the finance sector, offering access to a diverse pool of skilled software developers who may be challenging to find and afford locally. It enables finance companies to rapidly tap into top-tier tech talent from prime European hubs, ensuring operational proximity and cost efficiency. These professionals not only bring technical expertise but also experience in the finance sector.

Source: Market study: The Swedish market for IT services, Open Trade Gate Sweden, October 2024

Tokenized deposits are also emerging as a fast-growing trend in Sweden, with several payment providers exploring their potential to eliminate the need for pre-funded and multiple correspondent bank accounCost efficiency is one of the biggest drivers behind nearshoring in the finance sector, particularly in high-salary markets like Sweden. While onshore development offers local expertise and direct oversight, it comes at a significantly higher cost.

Offshore outsourcing, on the other hand, may provide cost savings but often introduces challenges related to communication barriers, time zone differences, and regulatory mismatches. Nearshoring strikes the perfect balance by delivering both affordability and operational alignment.

Comparing costs: onshore vs. offshore vs. nearshore

To illustrate the cost advantages of nearshoring, let’s compare software development costs in Sweden (onshore), an offshore location like India, and a nearshore hub such as Poland.

| Development Model | Average Hourly Rate (USD) | Key Benefits | Key Challenges |

| Onshore (Sweden) | $50–$150 | High-quality talent, seamless communication, regulatory compliance | High costs, talent shortage |

| Offshore (India, Philippines) | $25–$40 | Significant cost savings, large talent pool | Time zone misalignment, cultural differences, compliance risks |

| Nearshore (Poland, Estonia, Portugal) | $40–$70 | Cost savings, skilled talent, cultural and regulatory alignment, real-time collaboration | Slightly higher than offshore but far more efficient |

NCube blog The Cost of IT Services in Europe

Seamless real-time collaboration

Nearshoring enables seamless collaboration thanks to similar time zones and geographical proximity. Nearshore teams working within overlapping business hours provide a unique advantage by aligning their schedules with those of the client company, ensuring real-time communication without time zone delays. Smooth connectivity through platforms like Zoom, Teams and email keeps the team aligned and the project on track, maintaining an uninterrupted workflow.

This alignment allows for continuous monitoring and immediate response to issues as they arise. Whether it’s a system malfunction, security concern or compliance update, the ability to address these issues promptly, improves operational efficiency and ensures synchronization of sensitive financial data.

Additionally, proximity makes it easier and more cost-effective to arrange in-person client visits, bringing the entire team together in one location, which is a key advantage of nearshoring over other outsourcing models.

Flexible and scalable solutions

Financial markets are volatile, so companies in this sector must respond swiftly to new regulations, shifts in customer behaviour, and emerging technologies. One of the reasons why nearshoring software development in finance is growing in popularity is its ability to help companies scale fast without local hiring delays.

Nearshoring allows them to easily scale their team as their business needs evolve. Finance companies can quickly adjust their resources without the time-consuming and costly processes of recruitment, training and onboarding new staff. By utilizing flexible and scalable solutions, they can drive sustainable growth while maintaining operational efficiency.

Additionally, nearshoring helps businesses in Sweden mitigate risks associated with technology changes. Nearshoring to specialized vendors ensures that financial institutions work with partners who are continuously updated on the latest advancements in technology and industry trends.

Shared values and cultural alignment

Cultural compatibility and shared values are crucial for the success of finance companies where trust is a cornerstone of operations. Development teams from neighbouring countries are more likely to understand the business principles and work culture of the home market.

For instance, the Swedish approach is direct and to the point, and nearshore teams from culturally similar countries can adapt easily to this communication style. Swedes also value punctuality and reliability, expecting meetings to start on time and deadlines to be met.

Nearshore teams align with these expectations because their countries share the same values, which leads to mutual understanding and timely project delivery.

In addition, cultural compatibility ensures that a nearshore development team can better resonate with end users in the home country, leading to more relevant financial products and features. Furthermore, due to regulatory similarities between neighbouring countries, nearshore teams often have a better grasp of financial compliance requirements.

Best practices for successful nearshoring in the finance sector

Choose a flexible nearshore team

Opt for a nearshore team with customizable collaboration models. Choosing a complete nearshore team or one with local project managers and product owners can eliminate language and location barriers while keeping costs effective without compromising quality.

Partner with a proven expert

Choose a nearshore team with a proven track record in the finance industry, as quality assurance and excellent software are paramount. Except for technical expertise, it is important to be familiar with broader knowledge and industry trends. When evaluating potential partners, look for trust key indicators such as years of experience, client logos, testimonials and a strong service portfolio. When selecting a partner for nearshoring software development in finance, verify their experience with financial compliance and real-time system integration.

Ensure clear communication

Given the complexity of financial regulations and security protocols, clear communication is essential. If your in-house team feels less comfortable with English, choose a nearshore provider with local professionals fluent in Sweden to minimize misunderstandings.

When VisualVest began its partnership with the nearshore software development team, they had a German-speaking Product Owner, Designer, and Scrum Master on the VisualVest side. To enhance collaboration, their nearshore team included a German-speaking Agile Coach to support the ramp-up phase and facilitate the team’s seamless integration into VisualVest. This approach contributed to improved productivity, collaboration and the successful development of a multi-tenant Conversational Platform.

Leverage a hybrid team

Consider a mixed-tech team that combines local and remote professionals to balance cost-effectiveness and scalability. This setup allows you to advance your digital finance products while maintaining efficiency and security.

Adopt agile methodologies

Given the dynamic nature of the finance sector, traditional project management methods often fall short. To succeed, finance companies should partner with nearshoring development teams that embrace agile practices. This involves conducting regular sprints, daily stand-ups and synchronization meetings to maintain alignment.

Key takeaways

Nearshoring software development presents Swedish finance companies with a strategic solution to address the growing demand for tech expertise.

By partnering with nearshore teams, finance institutions can access high-skilled professionals in areas such as full-stack software engineering, product development, data engineering services, cloud-native, user experience design and more, while ensuring both timely delivery and scalability.

This approach not only enables finance institutions to meet the immediate need for skilled professionals but also provides long-term benefits in terms of operational efficiency and flexibility.

Looking ahead, as the pressure to innovate increases, nearshoring plays an important role in helping Swedish finance companies stay agile and competitive. By utilizing nearshore partnerships, finance organizations can reduce costs, swiftly adapt to technological advancements and secure sustainable growth.